Content owner:

Facilitating Dialogue on Index insurance between the Public and Private Sector

Language:

English

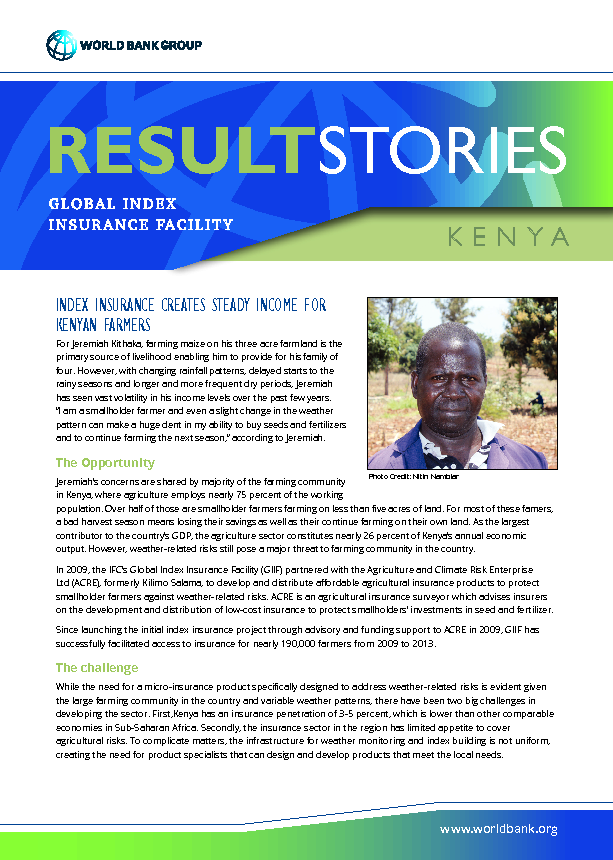

In june 2016, over 60 participants gathered at the College of insurance in Nairobi to discuss best practices and share their knowledge and expertise on index insurance, particularly livestock insurance and agriculture insurance. The discussions were quite timely, as the Government of Kenya recently allocated US$6 million for crop and livestock insurance for smallholder producers for next year, as one of the ‘key government flagship projects to drive the transformative agenda’. This is a five-fold increase in budget from the previous years with strong allocations toward data systems and...