Fri, 04/28/2023

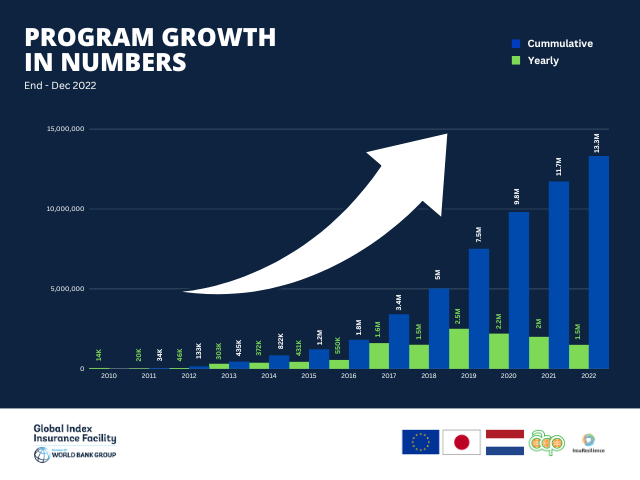

In 2022, despite the ongoing struggles of the COVID-19 pandemic, the GIIF Program successfully delivered significant results and continued building a strong pipeline to strengthen its ties with clients, other WBG projects and the donor community. All activities, projects, events, trainings, studies focus on further developing the markets. Since the launch of GIIF, more than 13 million agriculture insurance policies have been issued cumulatively, with an estimated outreach of 65 million beneficiaries globally. In these difficult conditions, as the GIIF team we would like to emphasize that we...