Digital Transformation in Agriculture Insurance: Developments and Challenges

Digital Transformation in Agriculture Insurance: Developments and Challenges

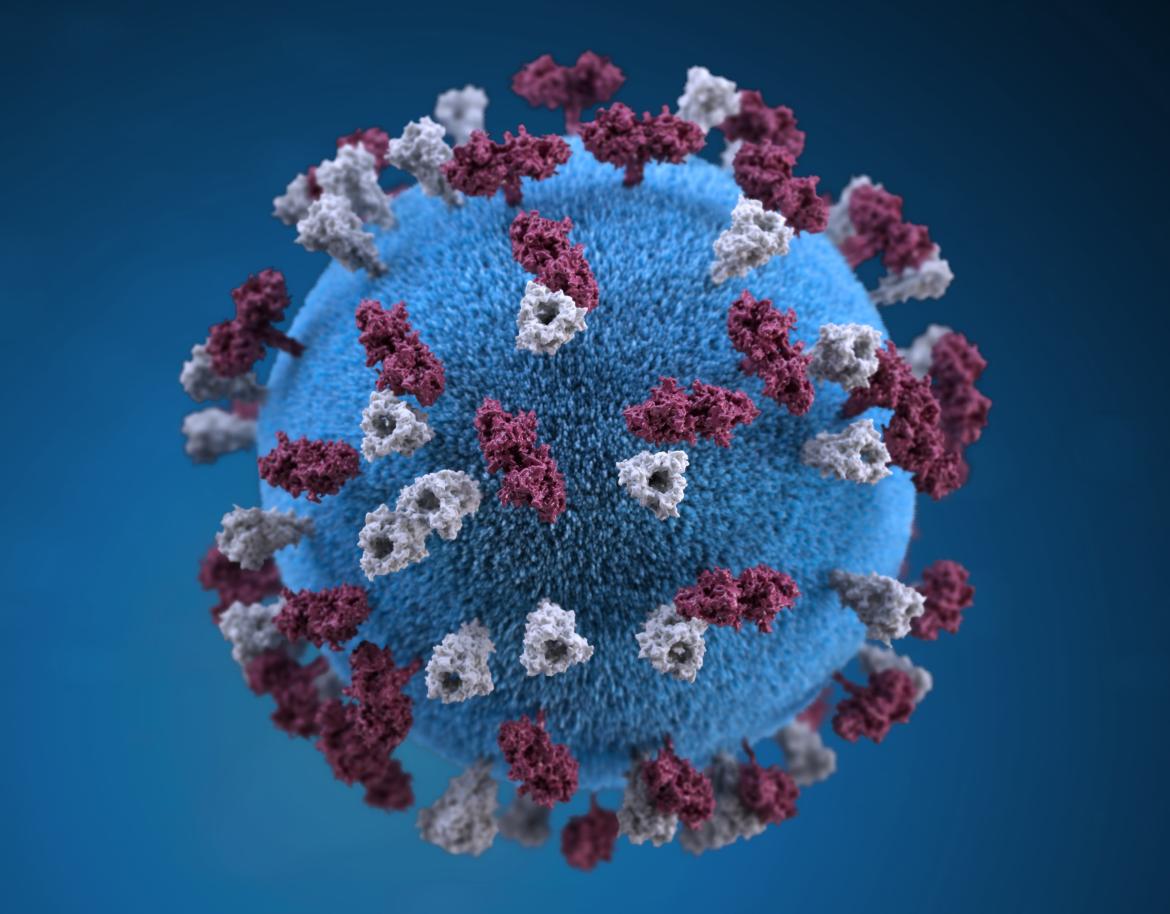

Although the industry direct and indirect losses from COVID-19 have not been studied systematically, 2020 marked a difficult and transformative year for the insurance sector. As part of containment measures imposed by the governments to curb the spread of the virus, economies worldwide were forced into lockdown causing inevitable second-order effects of supply chain disruptions, business closure, loss in income and jobs leading to third-order effects of poverty and food insecurity intensifying in the vulnerable communities. In fact, using the latest dataset, the World Bank recently released an increased estimates of COVID-19-induced new poor in 2020 to rise to between 119 and 124 million. The growth of agriculture insurance in the emerging markets, which can help relieve farmers from weather-related production risks to prevent falling into the poverty trap, is not immune to the overall difficulties experienced at individual, sectorial and country levels. The progress to close the protection gap is largely kept on hold amid competing financial priorities of households and the governments. Insurance companies, to navigate the difficulties and to minimize negative impact on their operations, have been increasingly using digital or insurtech solutions. The results from GIIF’s COVID client surveys conducted in the middle of last year also confirmed these general trends of reduction in farmer enrollment and various field activities as well as the speed-up in adoption of digital solutions including remote working by some of the implementing partners. The overall financial impact from COVID-19 on the business in 2020 will become clear in the next few months, which will be discussed along with findings from the follow-up survey in the future article.

According to the Centre for Financial Regulation and Inclusion (CENFRI), COVID-19 has made enabling digital sales a priority for insurers across African insurance markets. The CENFRI study reported 63% of 64 surveyed insurers, microinsurers and insurtechs in the continent have digitized, or are in the process of digitizing, their sales as a result of the pandemic. The availability of digital contracting depends on regulatory requirements and internal technological infrastructures. Currently 10 African countries permit e-signature to enable remote identity proofing (i.e. Know Your Customer (KYC)/Customer Due Diligence (CDD)), which involves collecting and verifying identify information electronically, and 51% of the insurance players use remote KYC onboarding to conclude sales. In addition to regulatory uncertainties around the legality of e-signature and remote onboarding in some jurisdictions, insufficient robust digital identity systems in the region where 45% of individuals do not have an official ID remains a hinderance to advance digital insurance.

Another survey on 13 regulators shows hopeful development that there are proactive, ongoing multilateral communication as well as virtual bilateral engagements to exchange experience and ideas. Some regulators have been encouraging innovation among the insurance industry such as NAICOM Nigeria, TIRA Tanzania and IRA Uganda. In South Africa, PA and FSCA, together with other financial regulators, launched the Intergovernmental Fintech Working Group (IFWG) Innovation Hub in April 2020. Those display good signs to potentially co-advance regulatory capacities to manage risks and promote prudent innovation with sufficient consumer protection in the sector.

Similarly, FSA Africa’s insurance study concludes that COVID-19 presents a unprecedented opportunity for both insurers and regulators to become better equipped to embrace and adopt innovation and develop their insurance markets. The Global COVID Fintech Market Study shows that Sub-Saharan Africa, with the highest concentration of FinTech headquarters being in South Africa, Uganda, Nigeria and Kenya, enjoyed 21% growth in transaction volume of digital finance. FinTech from SSA were much more likely to report the urgent need for regulatory support measures than FinTechs from other regions as more than half of FinTech surveyed from SSA expressed the urgent need for ‘faster authorization or licensing processes for new activities’, and ‘streamlined product or services approval’ and ‘e-KYC”. The improvement of FinTech space made possible by strong market request will have direct spillover benefits to the insurance space.

Photo Credit: CDC on Unsplash