2023 in Review: Protecting 70 million farmers against Climate Change

By Fatou Assah, IFC Financial Institutions Group, Global Head

As we embark on a new year, it's an opportune moment to reflect on GIIF journey through 2023, a year marked by significant achievements, innovative advancements, and a consistent commitment to enhancing climate resilience and financial inclusion for smallholder farmers, MSMEs, and cooperatives active in the agriculture sector through support of innovative solutions to the insurance industry.

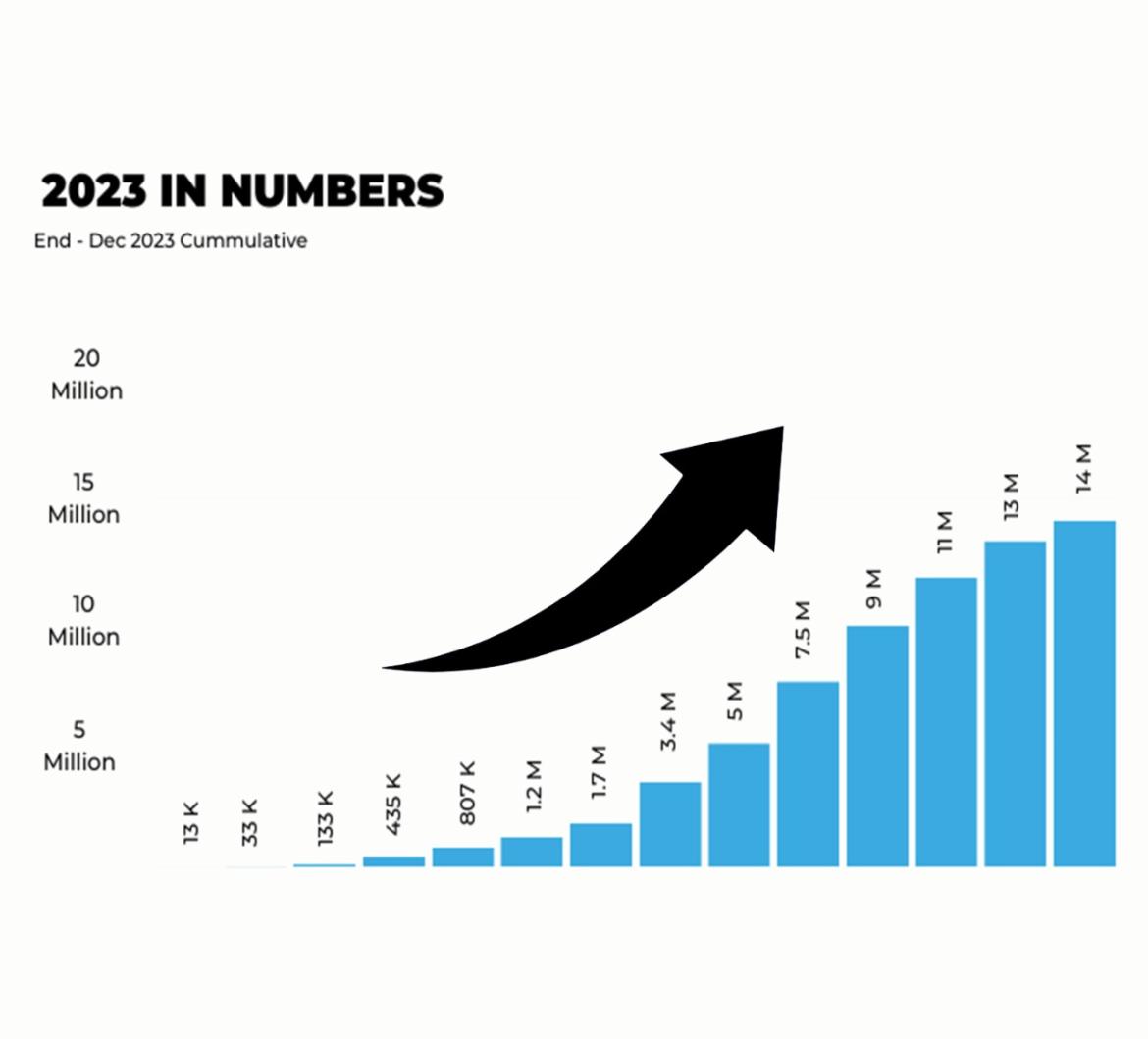

The year 2023 marked a significant milestone for GIIF, as we exceeded our initial targets and facilitated the issuance of over 14 million agricultural insurance policies to date. Reaching nearly 70 million beneficiaries globally demonstrates the increasing recognition of the negative impact of climate change on the rural ecosystem and the demand for climate risk management tools as a key factor in building resilience while escaping the fall into poverty. Our activities have expanded to impact insurance industries in Africa and Asia, , informing the development of innovative products insurance, analysis of institutional arrangements and policy frameworks, research studies, and knowledge exchange programs with a view to enhancing resilience and financial inclusion of those at the bottom of the pyramid.

Expanding Impact and Reach: we are happy to share with you a brief overview of our indicators of success, over the years (estimated cumulative figures):

Operational

• Implementing partners have directly issued +14M contracts, both individual or group-based policies, to small-holder farmers representing over 70 million beneficiaries.

• 400 distribution partners, including MFIs, Banks, Farmer Associations, and agribusiness aggregators, have actively participated in new partnerships to distribute climate policies, using insurance as collateral to access inputs or financing.

• Policy and regulatory capacity development projects have been conducted in 24 countries, with support provided in drafting new laws, amendments, and regulations, which gave lawful market access to 20 partners across Africa and Asia.

Knowledge Management, Training, and Others

• GIIF's Knowledge Management platform attracted over +400K page views, indicating a high level of engagement and utilization by members of our Community of Practice.

• A total of 2,946 insurance company personnel have been technically trained in climate risk insurance product design, distribution, reinsurance and claims management practices.

• Across countries in Africa and Asia, 2,781 knowledge and awareness-raising workshops have been conducted across IFC and WB projects and -sub-projects.

• The - GIIF's online e-learning modules has seen 372 trainees successfully completing each module in both English and French.

Innovative Initiatives and Partnerships: Our initiatives, such as the Africa Inclusive Climate Risk Insurance Program (AIIP), demonstrate our commitment to protecting farmers and MSMEs against climate risks. In its first year of implementation, the AIIP successfully collaborated with the Insurance Development Forum's Inclusive Insurance Working Group, the Microinsurance Network, the IDF Secretariat, and the UNDP's Insurance and Risk Finance Facility to organize stakeholder workshops in Senegal, Kenya, and the Philippines, focusing on inclusive insurance solutions and strategic partnerships and creating inclusive insurance solutions that effectively address the challenges posed by climate change.

Collaboration has been a key driver of our success in 2023. By partnering with other World Bank Group programs and development partners, we have engaged in a wide range of activities to address challenges in agricultural insurance and promote digital innovation in the insurance industry. Our capacity-building programs, feasibility studies, evaluations, and study tours across Africa and Asia, including Zimbabwe, Zambia, Mozambique, Cameroon, Kenya, and Nigeria, serve as key examples of how collaboration can yield impactful outcomes.

Regional Highlights and Digital Advancements

Our efforts spanned across continents, with significant activities in both Africa and Asia. In Africa, we initiated various projects, including supporting innovative distribution channels in Madagascar, conducting studies on the needs of rural women in the insurance sector, capacity-building training for stakeholders, and conducting livestock insurance feasibility studies in Nigeria. One - example is the case of Deborah Nzarubara, an emerging women entrepreneur, who were one of the finalists in the DRC Agribusiness Innovation Challenge, organized by GIIF to support young innovators in Climate Risk and Agri-Systems. She then -, emerged as one of eight winners at COP28 in 2023 in the 2023 YouthAdapt challenge, which recognized dynamic African young women-led businesses. Each winning business, including Deborah’s enterprise GRECOM, is set to receive grant funding of up to $100,000. This progression from national recognition to global acclaim exemplifies GIIF's role as an incubator of MSMEs, contributing to providing homegrown solutions to the Food Security crisis while empowering women entrepreneurs for a more inclusive approach.

In Asia, we have undertaken the India Agtech Project - leveraging technology to enhance climate risk management. Our focus on digital innovation has resulted in the development of mobile-based sales in Zambia and a digital product management system in Nigeria. These initiatives not only streamline processes but also improve the accessibility and affordability of financial services and climate risk insurance for vulnerable populations, particularly smallholder farmers.

Looking Ahead: Expectations for 2024

As we look to 2024, our agenda will focus on a more inclusive approach to climate risk. This will involve transitioning to the Global Inclusive Insurance Facility in collaboration with our partners from the Global Shield and donor countries prioritizing climate risk protection and food security. Our strategy will specifically include tailor-made product development using the latest spatial technologies, enhancing customer acquisition and management through digital services, embedding knowledge sharing with local businesses and teaching institutions, and expanding strategic partnerships. We will place a special focus on promoting women, either as beneficiaries or agents of change. In this vein, one of our new projects, in collaboration with the Federation of African National Insurance Companies (FANAF) and the IFC Women's Insurance Program (WIP), will aim to promote gender diversity and equality in the insurance industry across 28 African countries, recognizing the pivotal role of women in agriculture. Following a review of the success factors, we plan to replicate this pilot project in Asia.

As we reflect on the accomplishments of 2023, we are grateful for the support of our partners and the communities we serve. Looking ahead, we anticipate a year filled with growth, innovation, and deeper impact as we continue our efforts to foster a more resilient and financially inclusive agricultural sector.