Mon, 04/15/2024

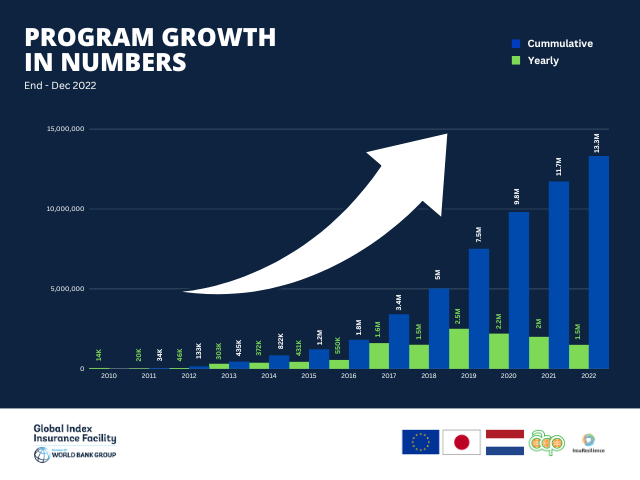

The PULA deal is crucial for IFC as it addresses the significant challenge of low agricultural insurance penetration across Africa, essential for food security. Limited field presence of insurers impede accurate risk assessment. PULA's operations and expansion plans offer a broad coverage, particularly benefiting small-holder farmers who are underserved by existing insurance arrangements. By training local agents and automating processes, PULA enhances operational scalability, vital for reaching more farmers effectively and building their trust. This aligns with the Finance Investement Group...