Content owner:

ACRE Africa

Topics:

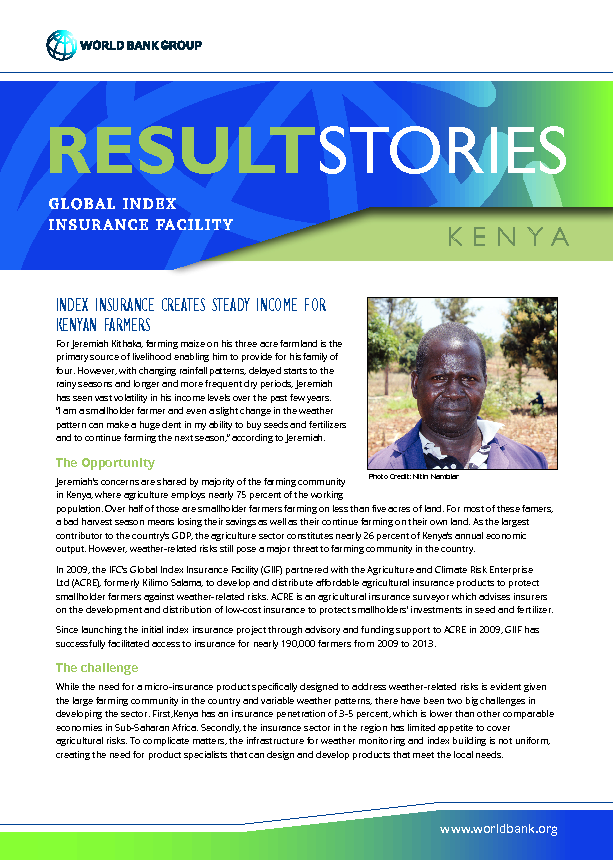

ACRE Africa participated in 2018 Understanding Risk Forum in Mexico City in May 2018. Organized by the World Bank’s Global Facility for Disaster Reduction and Recovery (GFDRR) and partners every two years, the event provides organizations and individuals with the opportunity to exchange knowledge, highlight new activities and initiatives, establish new partnerships, and foster innovation in the field. As part of this year’s program, the Disaster Risk Financing and Insurance Program (DRFIP) and the Global Index Insurance Facility (GIIF) – both in the WBG’s Finance, Competitiveness & Innovation