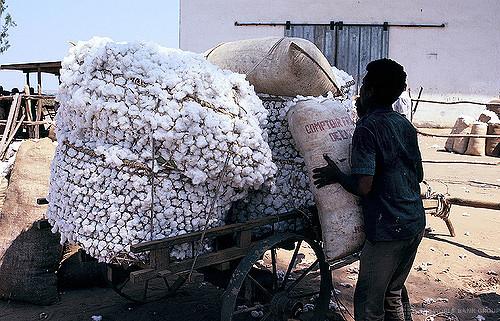

Karim Traore, President of Burkina Faso's National Union of Cotton Producers, speaks about the cotton farmer's experience with agricultural index-based insurance in a new GIIF Result Stories. “It would be difficult for me to provide exact data, however, I can tell you that index insurance strongly encourages farmers in their work, and we are finding that cotton production has increased in all of the areas where farmers have subscribed to it," says Mr. Traore. The Result Stories is part of a new bilingual series produced in 2017 to capture farmers' experiences with index insurance in Burkina

Burkina Faso

Content owner:

Global Index Insurance Facility

A newly designed Global Index Insurance Facility's Country Profile for Burkina Faso is available for digital viewing. The document contains an overview of GIIF's project in Burkina Faso and partner, PlaNet Guarantee. A French version is also available.

Content owner:

Topics:

With 1.5 billion people worldwide getting access to financial services through a post office, postal networks are powerful tools to advance financial inclusion. Posts have already proved to have comparative advantages in remote areas and with specific vulnerable groups – the poor, the less educated and those in the informal economy – compared with other financial services providers. This study by the Universal Postal Union (UPU) and the International Labour Organization (ILO) delves into the transformative potential of postal networks into well-suited providers of insurance. The report

Published on:

Topics:

Country:

The Joint GIIF-GAN Knowledge Sharing Forum “Assessing value from index insurance products” was organized by the Global Index Insurance Facility of the World Bank Group, USAID and Impact Insurance Facility of ILO in the morning of 16 September in Pacifica Headquarters in Paris. The client value of the cotton insurance project in Burkina Faso, implemented by PlaNet Guarantee, was assessed using 2 methodologies based on a double trigger approach. The scheme works on the average yield approach of the Group of Cotton Producers (GCP) and the yield of the neighbouring GCP in order to avoid all

Content owner:

Copyright © 2015 John Wiley & Sons, Ltd.

Download full publication Crop insurance in the Sahel enables farmers to take a higherrisk by getting more fertilizers.Crop insurance in the Sahel stimulates the production of insured farmers compared with non-insured farmers. However, despite the apparent differences in fertilizers and production, the two groups get almost the same yield. Non-insured farmers seem to be more specialized in agriculture.

Content owner:

GIIF - World Bank Group

"Farming in Burkina can be very challenging. Uncertain weather conditions can have severely damaging impact on harvests and the ability of smallholder farmers to continue farming," says Sou Campaore, a 42-year old cotton farmer from Houndé, a farming village just outside Dedougou, a city in the western corridor of Burkina Faso. "Since the income from such an unpredictable harvest is not steady, we don’t get access to capital in order to implement more efficient farming practices and purchase better inputs. A bad season can also have a telling effect on the health and social position of

Country:

PlaNet Guarantee, member of the PlaNet Finance Group, and the GIIF come together to launch the first regional management platform for index insurance. The objective is to cover 60 000 farmers in West Africa by 2015. While agriculture remains the main economic sector in West Africa (on average 30% of the GDP of countries in the region and 70% of the workforce), no risk management tool is offered to farmers to secure their income. In case of drought, floods, or due to other factors that could cause a significant drop in yields, farmers currently receive no form of protection. The traditional

PlaNet Guarantee activities in Burkina Faso started in 2010 and the first products were sold in 2011. MFIs and Banks were the main distribution partners. Such as a variety of distribution channels was the key to the project’s success.

Start date:

Country:

Region:

In 2011, at the request of CIMA and FANAF, a regional study on microinsurance was conducted with the technical assistance and financial support from the World Bank. This report showed that a new regional framework was required for microinsurance and agricultural index-based insurance, which had been absent, in the CIMA zone. The member countries are Benin, Burkina Faso, Cameroon, Central African Republic, Comoros, Chad, Cote d’Ivoire, Gabon, Guinea, Equatorial Guinea, Mali, Niger, Senegal, and Togo.