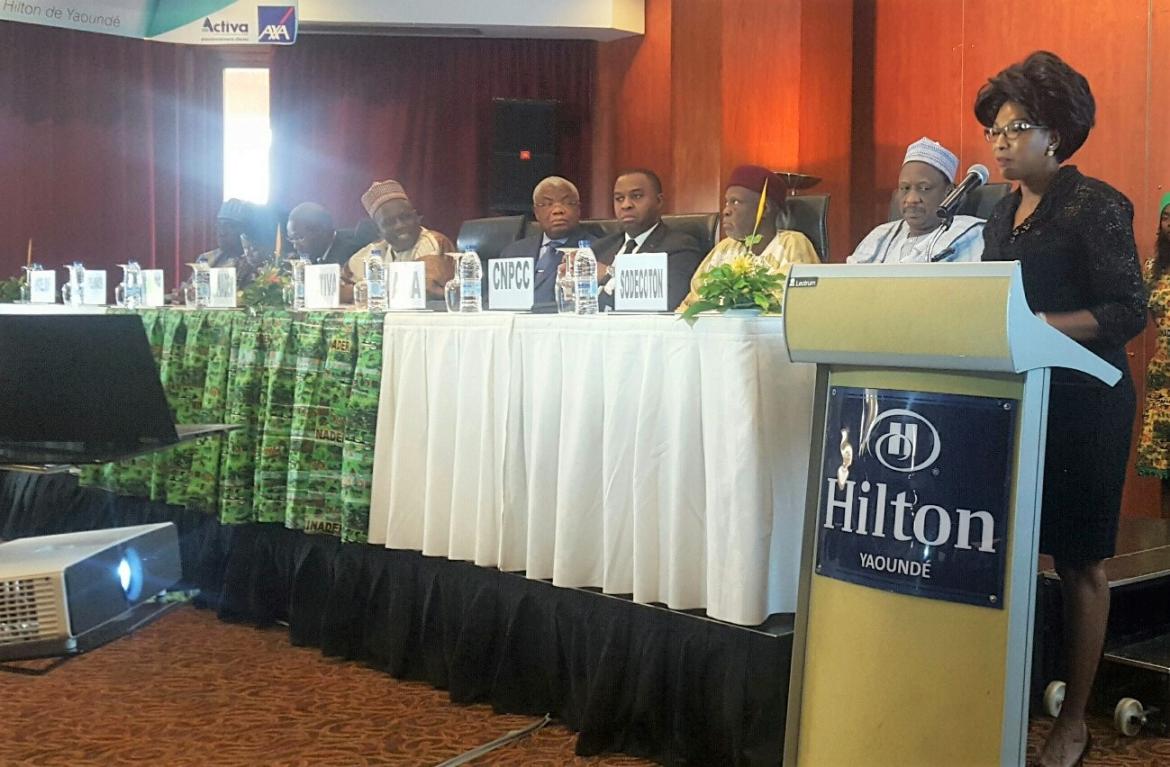

GIIF signed grant agreements with two Cameroonian insurance companies, ACTIVA Assurance and AXA Cameroon, to help tens of thousands of Cameroonian farmers and pastoralists, especially in the cotton, maize, sorghum and livestock sectors, acquire affordable insurance coverage. Both IFC partner insurance companies have already established strong relationships with cotton industry players - SODECOTON and the National Confederation of Cameroon Cotton Producers (CNPCC) - and have provided index insurance to nearly 8,000 cotton growers in the Northern region of the country for the 2019 campaign. To