Published on:

Country:

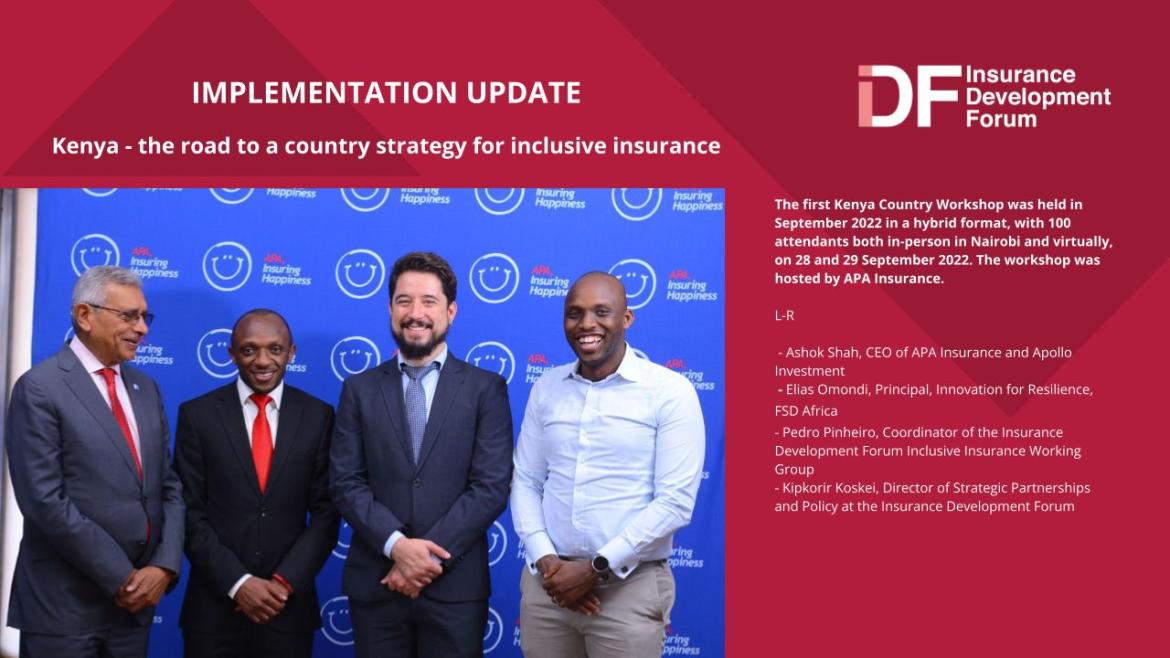

Last month, the Insurance Development Forum's Inclusive Insurance Working Group (IIWG) partnered with international organizations, local regulators, and insurance businesses to initiate a groundbreaking project in Kenya. Supported by key entities such as the United Nations Development Programme's Insurance and Risk Financing Facility, the World Bank Group's Global Index Insurance Facility, and the Microinsurance Network, the IIWG's goal is to foster inclusivity, innovation, and sustainable growth in Kenya's insurance sector. The inaugural Kenya Country Workshop, held on September 28 and 29