14

May

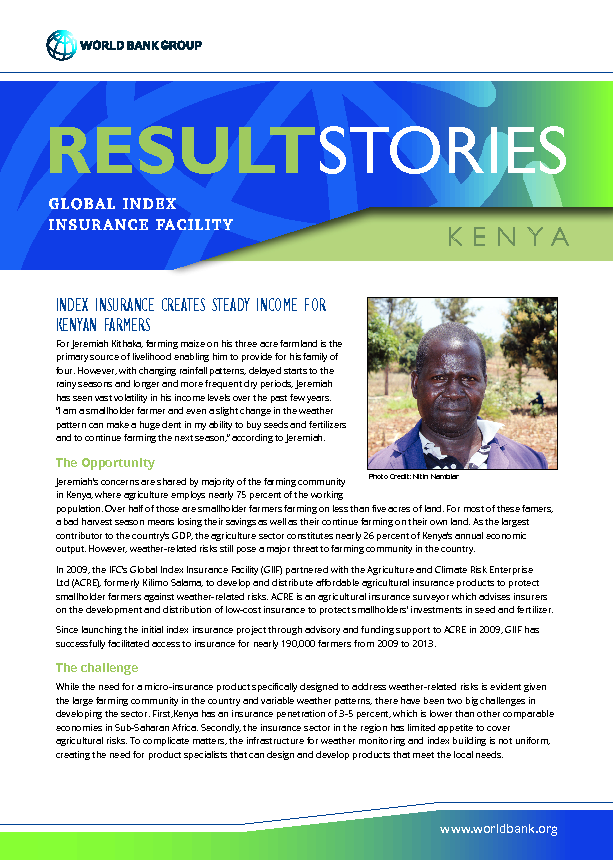

Can you give us some examples of key trade-offs that you have faced when providing technical support to the overarching policy discussion on regulation of index insurance in Kenya? The first trade-off that we have faced was in the definition of insurable interest. In the law of insurance, the insured must have an interest in the subject matter of his or her policy, or such policy will be regarded as a form of gambling. However, in Kenya most farmers do not own their land as they work on communal farms or as wage laborers. We therefore decided in our policy framework to define the insurable