Published on:

Topics:

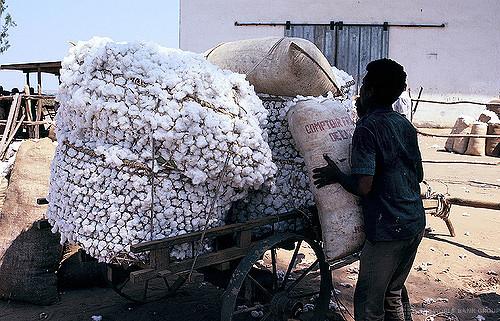

Country:

The Joint GIIF-GAN Knowledge Sharing Forum “Assessing value from index insurance products” was organized by the Global Index Insurance Facility of the World Bank Group, USAID and Impact Insurance Facility of ILO in the morning of 16 September in Pacifica Headquarters in Paris. The client value of the cotton insurance project in Burkina Faso, implemented by PlaNet Guarantee, was assessed using 2 methodologies based on a double trigger approach. The scheme works on the average yield approach of the Group of Cotton Producers (GCP) and the yield of the neighbouring GCP in order to avoid all