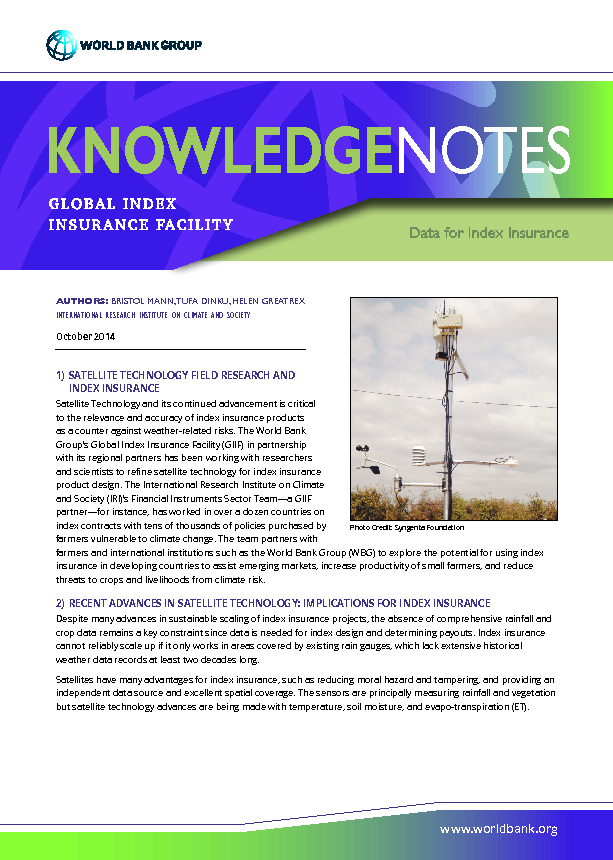

Content owner:

GIIF - World Bank Group

Satellite Technology and its continued advancement is critical to the relevance and accuracy of index insurance products as a counter against weather-related risks. The World Bank Group’s Global Index Insurance Facility (GIIF) in partnership with its regional partners has been working with researchers and scientists to refine satellite technology for index insurance product design.