Topics:

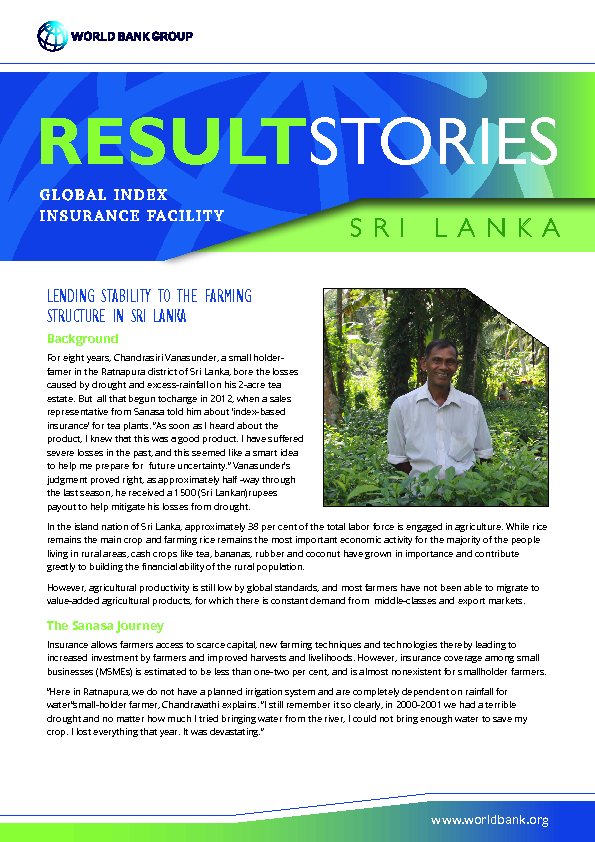

While access to credit is a key instrument toalleviate rural poverty, microfinance institutions(MFIs) are often unable to expand their agriculturelending portfolio. One of the key constraints thatMFIs face is the exposure of agriculture lending toshocks such as drought, flood, or locust which can putfarmers in a situation where they are unable to repaytheir loans. Major agriculture shocks can indeed leadto loan defaults and bank runs therefore resultingin destruction of risk capital, reduced access toliquidity, decreased lending and sometimes insolvency.Evidence shows that credit supply