Africa Risk Capacity (ARC) Group Spotlight Interview

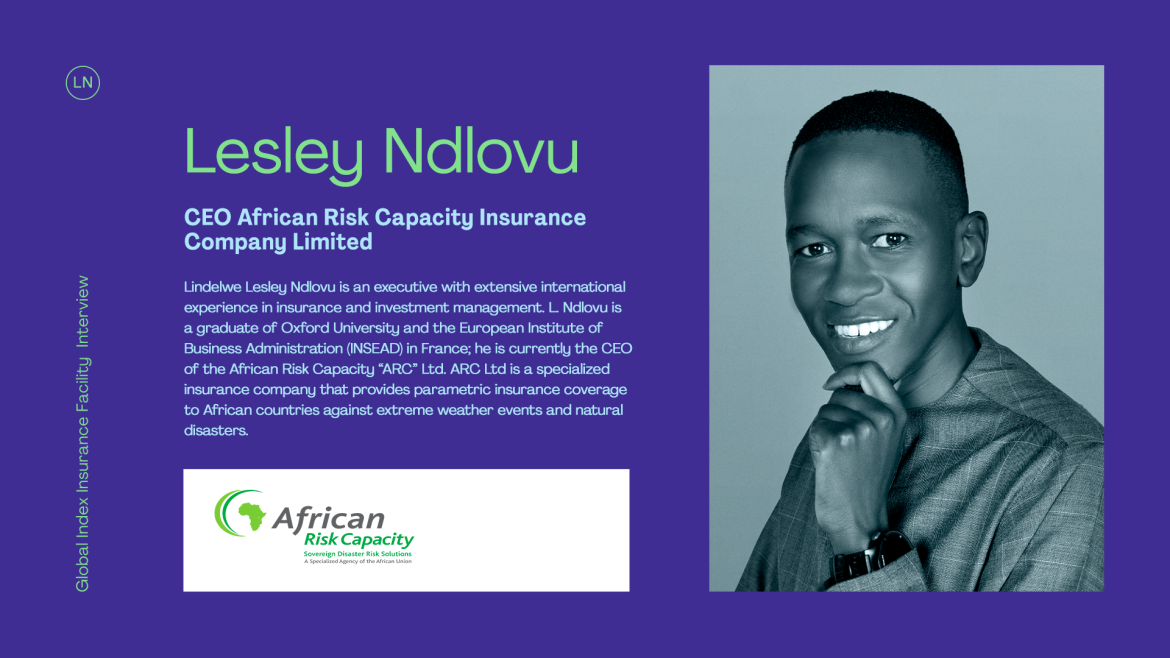

Background: During the just-concluded COP26, Africa Risk Capacity (ARC) Group showcased its lessons learnt in implementing continent-wide climate risk resilience initiatives for millions of Africans through dynamic partnerships. ARC Group also received new funding for scaling its reach and impact to safeguard livelihoods for the most vulnerable at the frontlines of climate change-mediated hazards. The Global Index Insurance (GIIF) team caught up with the ARC Limited CEO, Mr. Lesley Ndlovu to reflect on key milestones in 2021 and the main takeaways from COP26.

GIIF: ARC Group focusses on planning, preparing and responding to keep climatic events from turning into disasters. How has this strategy played out in protecting the most vulnerable in Africa? What have been the challenges in implementing this approach?

Lesley Ndlovu: Climate change is one of the greatest challenges that we face in the world at the moment. Within the African context, it manifests itself through the increasing frequency and severity of natural disasters, such as droughts, floods, and tropical cyclones. At the African Risk Capacity (ARC) Group, we work with African countries to help them plan, prepare and respond to natural disasters. We have within the ARC Group, two complementary institutions, the first of which is a development agency, aptly named ARC Agency while the second is ARC Limited. ARC Agency works with countries in terms of understanding their risk profile, which is their exposure to natural disasters. It works with countries to develop a national strategy for comprehensively responding to these natural disasters, and also on the political engagement necessary to sustain the commitment to a proactive disaster risk management approach.

ARC Limited is an insurance company that provides insurance coverage to countries against natural disasters such as droughts, floods, and tropical cyclones. We have been in existence since 2012. At the moment, 35 African countries have signed up to be part of the ARC Group through the treaty, and about 13 countries regularly take out insurance with us. Our member countries represent a good cross-section of the regions within our continent.

The biggest challenge that we have faced in this endeavor is getting countries to sign up for insurance policies, because the payment of insurance premiums competes with other national priorities such as defense, education and health especially within the context of Covid-19. In this regard, we have worked with the donor community to create a dedicated fund that provides subsidies that allow African countries to purchase insurance coverage and thus benefit from the risk transfer solution that we provide. To put this in perspective, in 2020, ARC Limited was able to pay out $23.5 million to the Government of Senegal for drought relief – representing one of our largest payouts – within 10 days to immediately launch relief operations.

GIIF: What does ARC see as the market potential of climate risk insurance for non-sovereign clients, and for key sectors like agriculture, health, others?

Lesley Ndlovu: Agriculture is one of the most important sectors for African economies. It contributes about a third of Africa's GDP and employs directly and indirectly about two thirds of Africa's workforce. When you look at the insurance penetration across Africa, it is quite low. By insurance penetration, I am talking about the insurance revenues compared to the GDP of the country. This ratio is even lower within the agricultural sector. This historically has been because it is difficult to distribute insurance to small- and medium scale farmers because while in aggregate the market is large, the insurance premiums paid by each individual farmer are quite small.

However, with the advent of technology, it is now becoming economical to underwrite and provide insurance to these small to medium scale farmers. Therefore, it means that the potential for insurance to grow within the agricultural sector is massive and insurance could become an even bigger part of the economy.

This coverage of insurance is important at a number of levels.

Firstly, it makes the agricultural sector more resilient because whenever there is a natural disaster, the farmers will have the financial means to be able to relaunch their economic activities. Secondly, it contributes to the formalization of the financial sector, by having more money being channeled through the insurance industry and which can then be invested in infrastructure projects – thereby improving the productivity of key sectors such as agriculture itself and manufacturing. Therefore, there is huge potential in the agricultural insurance sector. If you look at, for example, the numbers coming from the African Development Bank, they expect that investments in the agricultural sector will reach around $25 billion per year. Subsequently if say one percent of that is going towards the (agricultural) insurance industry; that's already $250 million of revenues going to the insurance sector representing a significant growth potential within agricultural insurance. For us at ARC, we are positioning ourselves in this space.

Lastly, we see the market-based solutions provided by the private sector as the most sustainable way to expand the agricultural insurance market . The private sector brings market discipline which allows adequate pricing which in turn supports best practices in risk management. The pools of capital that are required in this sector cannot be satisfied through development aid alone. We need the crowding in of the private sector to support this.

GIIF: What opportunities does the ARC see for collaborating with the World Bank Group, and specifically with IFC, on broadening access to climate risk insurance products across Africa?

Lesley Ndlovu: The World Bank Group plays a pivotal role in catalyzing and creating new markets. In the nascent agricultural insurance or climate risk insurance market, the World Bank Group plays an important role in terms of sensitizing the market, providing training, and engaging with regulators so that they create the enabling regulatory environment for product innovation to occur. Specifically, with the World Bank Group, we have been collaborating on specialized insurance initiatives such as the DRIVE[1] project in the Horn of Africa. We have also worked with the World bank Group on specific country projects, such as in the DRC, in Sierra Leone, in Mozambique, and in many other countries, because the ethos and values that we both have are similar: we have on the one hand the market development mandate, but we also have a very strong developmental mandate on the other. We see a huge opportunity for collaboration with IFC investee companies. IFC’s MD Makhtar Diop and the ARC Group Director-General Ibrahima Chiekh Diong met just before COP26. From this meeting we see important opportunities for collaboration including in capacity building initiatives.

GIIF: The ARC Group is one of the leading disaster risk agencies in Africa with a passion for innovation. In 2021, ARC Group expanded into flooding risk. What informed this decision?

Lesley Ndlovu: At our very core, we are an organization that is demand-led, which means that all the innovations are at the service of our members. So before we launch a new product, we have very deep and detailed discussions with all the countries that are members of ARC Group and we agree on the priorities…on what the roadmap looks like. Then the onus is on us as an institution to provide the thought leadership and the drive on innovation to create customized risk transfer solutions. The three most common weather-related perils on the African continent are droughts, floods, and tropical cyclones and we are now able to provide insurance solutions that target these perils. In addition to the weather-related perils, we are also working on disease outbreaks and epidemics. Given the outcomes of the Covid-19 pandemic, we have realized the heightened need to have solutions that go beyond just weather-elated risks, and really address the totality of the risks that are faced by our member countries. So being able to respond to the unique needs and demands of the member states is really a passion within the ARC Group and is the guiding light in terms of everything that we do.

GIIF: During the just-concluded COP26, ARC received $ 18 million from the German government on behalf of its members to increase its disaster risk underwriting capacity and scale. How and what will this funding be used for?

Lesley Ndlovu: As I alluded to, one of the barriers that prevent countries from taking up insurance is the high cost of insurance premiums. Therefore, to allow more countries to be able to purchase insurance, we have raised funds from donors that subsidize part of the cost of insurance premiums. The German government has generously provided us with $18 million, but it's part of a much wider initiative. We have so far raised over $80 million (jointly) from the German government, the U.S. government, the Swiss government, and the UK Government to create a funding pot dedicated to providing subsidies for insurance premiums, thereby allowing more countries to purchase insurance, allowing more countries to be protected by insurance, and to have more African covered by insurance. As an example, we are providing insurance coverage to about 30 to 35 million African citizens every single year and this money that's provided by the German government is a key pillar in enabling us to cover more people, making insurance more accessible, more available, and more affordable.

GIFF: What does the future of climate risk insurance look like to you?

Lesley Ndlovu: This is going to be one of the fastest growing segments within the insurance industry because there is a huge need, just given what we're experiencing at the moment regarding climate change. The sector has large headroom in developing markets, mainly in agriculture insurance, and this is because so far it has been difficult to access the agricultural market. But now thanks to technology, it's become a lot easier to access the agricultural market and subsequently we should see a rapid growth in that sector. From what I've seen, the market size is doubling every year.

Allow me to elaborate on the issue of technology.

Previously, the thinking and experience was that it was difficult to get access to the end farmer, right? Now farmers have mobile phones, they're able to sign up for an insurance policy through Unstructured Supplementary Service Data (USSD) codes or using apps. You can also answer their questions very quickly using chatbots. The cost of customer acquisition is dropping, the cost of customer interaction is dropping, and as an insurer you can pay claims using M-PESA, for example if you’re in Kenya. As we’re seeing, what was expensive, was how you interacted with the customer: but technology is dropping that cost so you can sign up more customers.