27

Oct

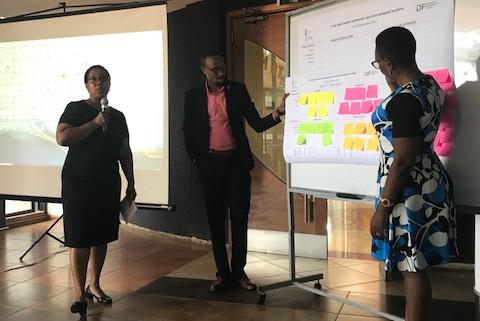

The GIIF Program hosted a knowledge exchange session at the 2022 International Conference on Inclusive Insurance, held in Jamaica between 24-28 October 2022. The International Conference, hosted by the Munich Re Foundation, the Microinsurance Network and the Insurance Association of Jamaica, was attended by over 400 experts from 50+ countries. The objective was to offer a platform to discuss and identify ways of accelerating growth and economic viability in inclusive insurance for emerging markets. In this conference, the GIIF program hosted a session on agriculture index insurance focusing on