TARSİM’s Role in Advancing Agricultural Insurance in Türkiye

Question: From your perspective as a specialized agricultural insurance pool in Turkey, what are the primary obstacles faced by TARSİM in providing effective climate insurance for farmers, and how can these challenges be mitigated?

R: TARSİM is a state-supported system that provides protection for farmers’ sources of income—such as crops, greenhouses, aquaculture, and livestock—against various risks. It covers their losses, ensures the sustainability of agricultural production, and operates as a non-profit organization committed to maintaining sustainable agricultural activities. Established in 2005 under the Agricultural Insurance Law, TARSİM has been serving producers across Türkiye since 2006.

By encouraging farmers to continue agricultural production, TARSİM contributes to stable agricultural output. The system plays a crucial role in managing natural disasters and various climate-related risks effectively and efficiently. It supports the development and expansion of agricultural insurance while reducing the financial burden on public resources.

A key obstacle to delivering effective agricultural insurance is the insufficient awareness among farmers and producers about TARSİM’s operations. This includes limited knowledge of the government’s premium subsidy of up to 70%, the extensive coverage available, the wide range of insurance products that address all agricultural areas, available discounts, and flexible payment terms. Today, agricultural insurance is recognized as one of the most effective tools for mitigating risks in agriculture. As farmers seek to reduce income losses and maintain economic stability, the importance of agricultural insurance continues to grow.

To address this, systematic and regional awareness campaigns are being implemented to expand the system’s reach and engage a broader producer base. Farmers’ satisfaction is regularly assessed through surveys, and actions are taken based on the findings. While the role and visibility of agricultural insurance have increased over the years, the number of private agencies contributing to the system’s outreach remains limited. Empowering these distribution channels to play a more active role will help expand the adoption of agricultural insurance practices, enhance accessibility for more producers, and raise awareness of insurance products and their benefits.

In order for producers and growers to be insured and benefit from the state’s premium support, they must be registered in the systems specified by the Ministry of Agriculture and Forestry and keep their records up to date. In the future, increasing the number of registered farmers will further support the growing uptake of agricultural insurance in Türkiye.

Question: Given the increasing frequency of climate-related disasters, what collaborative efforts are being made by TARSİM with other stakeholders, such as government bodies and reinsurers, to enhance the effectiveness of agricultural insurance?

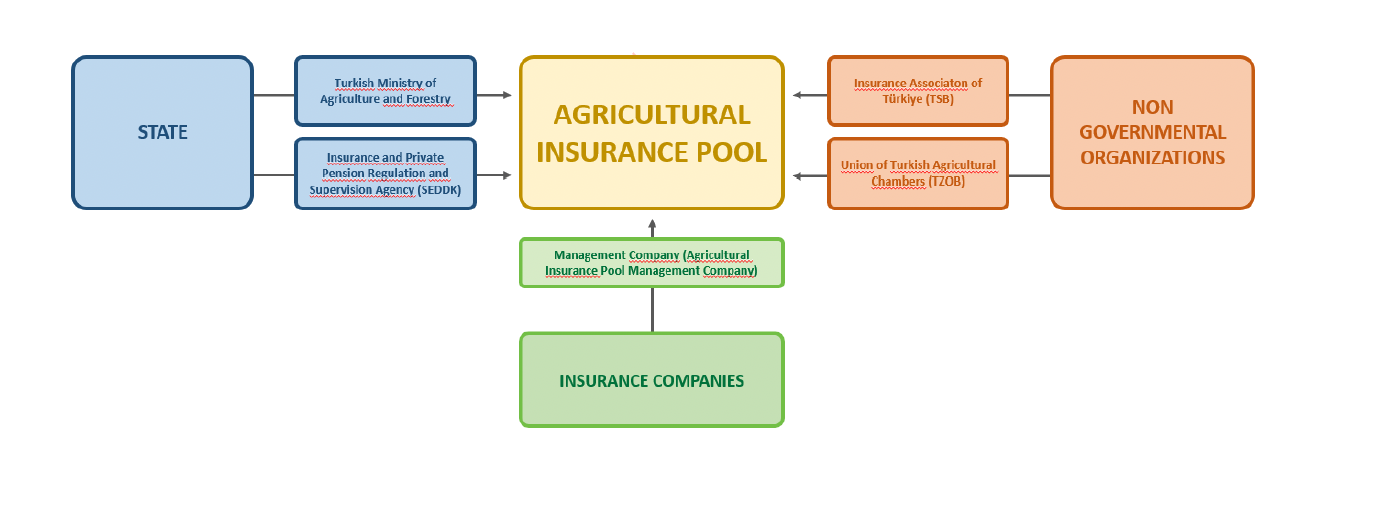

R: TARSİM stands as one of the best examples of collaboration between government, the private sector, and non-governmental organizations in Türkiye. Its key stakeholders include the Ministry of Agriculture and Forestry, the Ministry of Treasury and Finance—represented by the Insurance and Private Pension Regulation and Supervision Agency (SEDDK)—as well as the Insurance Association of Türkiye (TSB), the Union of Turkish Chambers of Agriculture (TZOB), and the Agricultural Insurance Pool Management Company.

Corporate Structure:

Agricultural Insurance Pool Management Company

All operations and transactions of the Agricultural Insurance Pool are managed by the Agricultural Insurance Pool Management Company (TARSİM), which is jointly owned by 27 member insurance companies. State-supported agricultural insurance policies are issued through the authorized agencies of these member companies.

With the valuable contributions of all stakeholders, TARSİM continues its mission with the vision of being an exemplary institution—one that has earned the trust of Türkiye’s farmers and provides the most comprehensive insurance coverage possible. This includes coverage across every region where agricultural production takes place, for every crop cultivated, in alignment with the spirit of the Türkiye Century.

We would like to extend our sincere thanks to Ayşe Berrin Bice for her coordination support, and to Bekir Engürülü for his valuable insights, which greatly enriched this piece and helped showcase TARSİM’s important role in advancing agricultural insurance in Türkiye.

We also appreciated TARSİM’s participation in the Disaster Risk Finance Academy, held in Istanbul in April 2025. Organized in collaboration with the Turkish Catastrophe Insurance Pool (TCIP), the Insurance Development Forum (IDF), and academic partners, the event provided a timely platform for global stakeholders to exchange knowledge on strengthening disaster risk finance through public-private partnerships.