Can Kenya Leapfrog Africa’s Microinsurance Market Through Digital Platforms?

Kenya, dubbed, Africa’s “Silicon Savannah” is leading the charge in technological innovations in financial inclusion. It is among the continent’s leaders in insurtech innovations. Could the widespread use of mobile money, coupled with a supportive regulatory environment spur the development of inclusive insurance for the underserved? These were among the questions that more than 60 insurance stakeholders recently addressed during the First Insurance Development Forum (IDF) -Microinsurance Network (MIN) Country Workshop on Inclusive Insurance in Kenya during September 28 and 29, 2022. Kenya is among the 21 focal countries prioritized by the IDF’s Inclusive Insurance Working Group. In Kenya, Mexico, Indonesia and the Philippines, in-depth engagements have been planned to map the investments, stakeholders and actions needed to scale inclusive insurance.

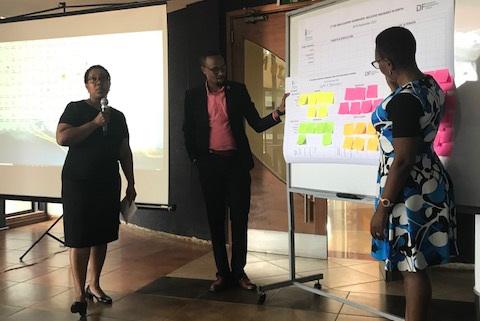

Hosted by APA Insurance and led by IDF’s Inclusive Insurance Working Group Coordinator, Pedro Pinheiro, the workshop sessions ignited discussions about the current state of play and future innovations in inclusive insurance in Kenya. Over the course of two days that included expert presentations and a design sprint, participants traced the evolution of microinsurance and brainstormed on the key elements of an inclusive insurance roadmap in Kenya. Key landmarks include the Kenya Microinsurance Landscape Paper of 2010, the Microinsurance Regulations, the National Insurance Policy 2021, the setting of the regulatory sandbox and the Bima Lab I and II Accelerator.

During the discussions, it emerged that developing microinsurance products that were easy to understand and use and leveraging Kenya’s mobile money platforms for premium collection and claims payouts could dramatically improve uptake of insurance by the most vulnerable. Those at the base of the pyramid and micro and medium scale enterprises (MSMEs) face multiple risks and require flexible yet robust risk management strategies that include fit-for-use insurance. For smallholders, the risk management solutions could go beyond agriculture index insurance when considering climate risks, while for MSMEs bundled products should include health and income protection components. For MSMEs, their health and livelihoods are intricately related, and the Covid-19 pandemic had brought into sharp relief the need to have comprehensive yet affordable insurance to prevent a fall into poverty following a catastrophic health event.

Despite the move to digitalization of insurance in Kenya, industry experts confirmed that the human element was still required in product design as well as distribution through the use of insurance ambassadors amongst the underserved eg ride-hailing drivers to create greater awareness on product features. The workshop also offered the opportunity for knowledge transfer from other regions. A case in point is Pioneer Insurance in the Philippines which has many industries best practices including product innovation and prompt claims payments. By adopting a similar approach and accompanying the customer throughout the customer journey, insurers can gain greater trust and transform insurance from a service that is sold to one that is bought.

What would the ideal microinsurance product for the Kenyan market look like? Stakeholders proposed a

single-fee platform for a multi-risk product with one front-end application whereby all underwriters could be hosted. This dynamic platform will simplify uptake, reduce friction during premium payments and eliminate price undercutting among underwriters. The battle for the emerging consumer in Kenya would thus be on service and quality, and not on price.

At the end of the two days, the Kenya Taskforce on Inclusive Insurance was formed. This Taskforce will drive the development of the country’s Inclusive Insurance roadmap and support Kenya’s efforts to leapfrog the continent in inclusive insurance.

For more information on the IDF’s inclusive insurance work in Kenya see a related interview with Pedro Pinheiro here.