27

Jun

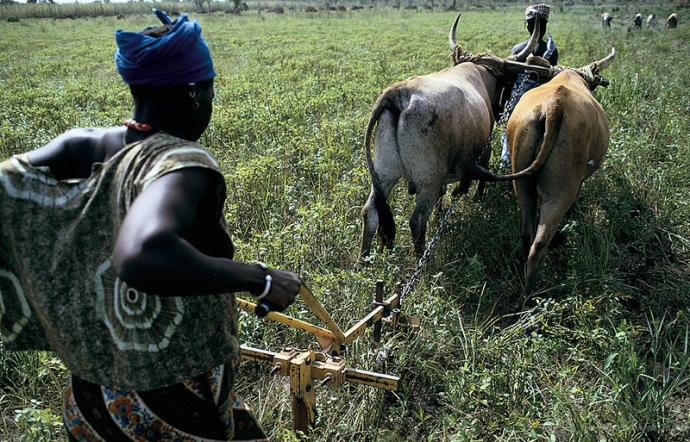

On May 18, colleagues from the Gender Innovation Lab at the World Bank hosted a webinar titled "Let her Grow: Addressing the productivity gap in agriculture—Barriers and promising interventions." The webinar presented the findings from three studies on productivity gaps between women and men farmers in Timor-Leste, Democratic Republic of Congo (DRC), and Côte d’Ivoire. These studies presented new evidence on the most binding constraints faced by women farmers, and effective interventions to address these constraints. Each of the studies examined different aspects of this issue and presented